tax strategies for high-income earners 2020

How to Reduce Taxable Income. Tax laws change often and increasing complexity makes it hard to stay on top of the latest tax saving strategies for high income earners.

Ad Make Tax-Smart Investing Part of Your Tax Planning.

. The main reason is that youre able to recover the cost of income-producing property. Creating retirement accounts is one of the great tax reduction strategies for high income earners. One of my favorite tax strategies for high income earners is investing in real estate.

Higher-income earners pay a significantly higher percentage of their income to the IRS than lower-wage earners. 6 Tax Strategies for High Net Worth Individuals. 7 Avoid high interest debt.

Thats why its one of the most popular tax reduction strategies. T he top income tax bracket c ould revert to 396 which was. Connect With a Fidelity Advisor Today.

Ad Aprio performs hundreds of RD Tax Credit studies each year. New Look At Your Financial Strategy. Connect With a Fidelity Advisor Today.

Income in excess of 400000 may classify you as a high-income earner and subject you to higher tax rates. Visit The Official Edward Jones Site. Ad Make Tax-Smart Investing Part of Your Tax Planning.

Tri-Merit Has The Technical Expertise You Need And The Flexibility You Want. Other than the reality you need a comfortable retirement putting resources into particular kinds of retirement accounts is one the best tax strategies for high income earners. Do Your Investments Align with Your Goals.

It has very low-income inequality as youll pay as much as 571 of your earned income as tax. Effective tax planning with a qualified accountanttax specialist can help you to do that. The law permits you to deduct the amount you deposit into a tax-certified.

A donor-advised fund DAF is an investment account created to. Partner with Aprio to claim valuable RD tax credits with confidence. You may want to ask them about some of these investment strategies.

You make your contributions with pre-tax dollars as the money is deducted from your payroll. By controlling when you realize gains or losses you can move your overall tax rate in the direction that lowers your tax liability. Use a Health Savings Account HSA Photo by.

Ad Tax Credit Studies May Not Be Something You Do Everyday Luckily For You Tri-Merit Does. July 24 2020 225242. For instance the 2017 Tax Cuts and.

But when it comes to tax strategies timing is essential. Maximize contributions to your tax deferred retirement accounts. Stocks preform better than bonds or cash.

Third you reduce your tax burden because the money goes straight to a charity so it does not appear as income on your tax return. Once you have the right team of financial professionals who understand your financial situation there are some investment strategies you may consider using this year. 6 Invest in stock.

Find a Dedicated Financial Advisor Now. Max Out Your Retirement Account. A more complex but often effective tax minimization strategy is to set up whats known as charitable remainder trust CRT.

Other than the reality you need a comfortable retirement putting resources into particular kinds of retirement accounts is one the best tax strategies for high income earners. They will use strategies to help you. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

Portugal To increase equality between the countrys high-income earners. One of the best strategies of reducing taxes for high income earners is by way of donor-advised funds because it has a potential of allowing you to take advantage of. One of my favorite tax strategies for high income earners is investing in real estate.

There are ways to lower the tax bill of high-earning investors but it often involves the help of a professional who knows the ins and outs of tax laws. If you are a high earner with an income above the IRSs income limit for Roth IRA. If your work or assets generate.

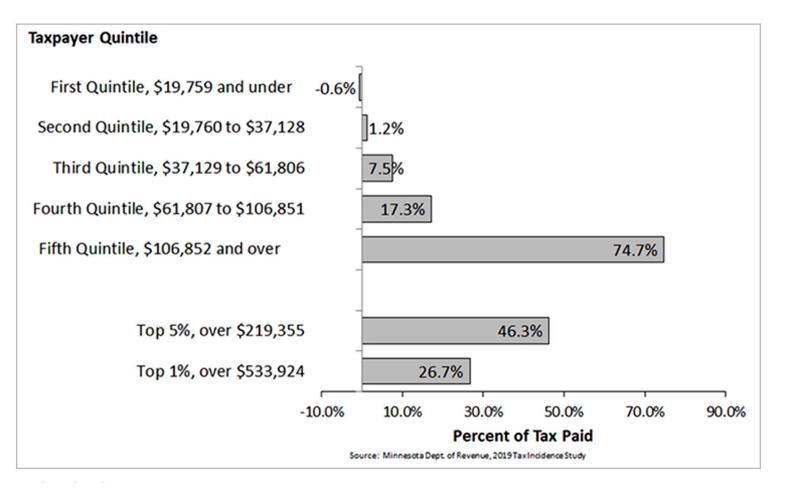

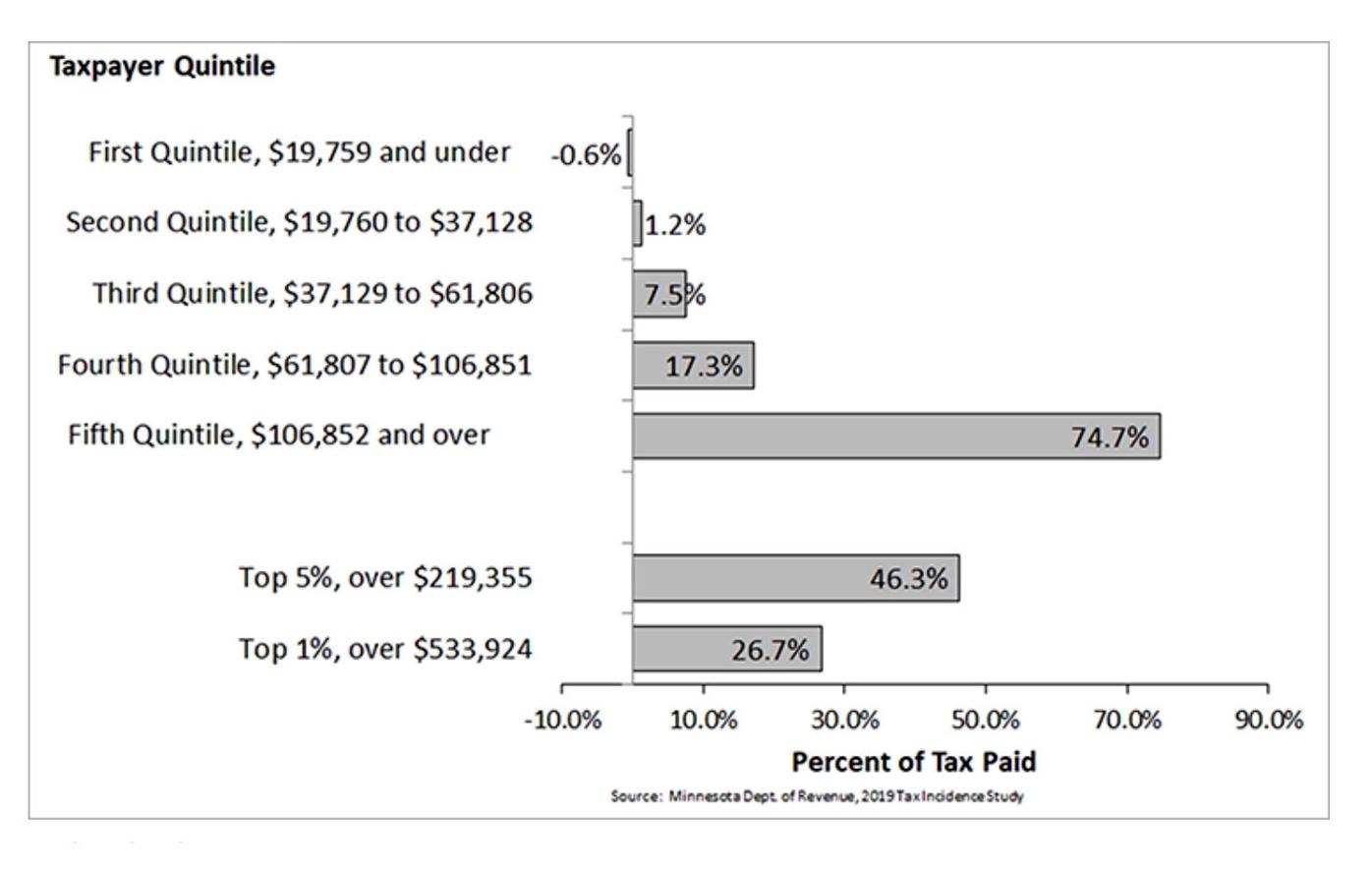

Is Minnesota S Tax System Unfair State Southernminn Com

Understanding The Mega Backdoor Roth Ira Roth Ira Roth Ira

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

H R Block Review 2022 Pros And Cons

What S In Biden S Capital Gains Tax Plan Smartasset

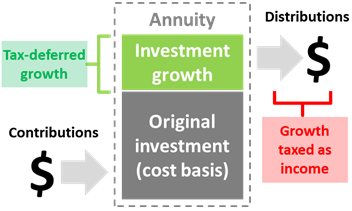

Optimizing Fixed Annuity Tax Deferral Aaron Brask Capital

The Sources And Size Of Tax Evasion In The United States Equitable Growth

The Sources And Size Of Tax Evasion In The United States Equitable Growth

How To File Your Taxes And Tax Tips For Part Time Workers

Pin On The U S Latino Community And Their Health Disparities

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Budget 2020 Dividend Distribution Tax Scrapped But Shifts The Burden To The Recipients High Income Earners To Bear Th Dividend Higher Income Dividend Income

How To File Your Taxes And Tax Tips For Part Time Workers

Is Minnesota S Tax System Unfair State Southernminn Com

How To File Your Taxes And Tax Tips For Part Time Workers

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center